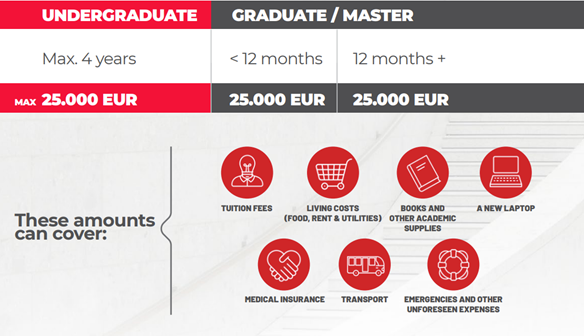

Students from Europe has a possibility to apply for the loan for his or her studies, offered by FINS, which is offered to both undergraduate and postgraduate students for studies abroad, in any European country, including the United Kingdom and Switzerland.

FINS is a member of EDUCATIVA, a group of companies with 12 years’ experience in delivering education services.

- Loan application process based on the university admission process

- Affordable interest rate

- No previous job or earnings required

- No physical guarantees or mortgage needed

- No costs for early repayment

- Grace period for the principal:

- The whole duration of the study period

- + 6-12 months after the study period

- Friendly communication & flexibility throughout the loan application, usage and repayment periods

Who can access FINS loans?

Fixed eligibility criteria

- Students need to be citizens of an EU member state.

- Students are preparing to apply, have applied, or are already accepted at a bachelor or master programme offered by a university in Europe (including UK and Switzerland)

- Students must have a clean financial record, e.g. not blacklisted with any outstanding/ unpaid debts for previous loans by any other financial institutions

Why choose FINS?

- Customized loan offer, based on the budget submitted so we avoid overborrowing

- Loan given in installments on an as-needed-basis – we avoid overspending and unnecessary interest fee payments

- Interest rates:

- Between 9% – 12.5% during the study & grace periods

- Interest can decrease to 9 % starting in the 7th month of the repayment period

- Grace period for the principal:

- The whole duration of the study period

- + 6-12 months after the study period

- FINS keeps in touch with students before, during and after their studies

- We will assist with job finding the alumni who wish to return in their countries

- Repayment is structured to be affordable, with long repayment periods:

- 5 years for Master graduates

- 10 years for Bachelor graduates

- But students can pay-off the loan earlier, with no extra costs

For evaluation purposes FINS are considering

- The reputation of the university and of the programme

- Employability statistics Job prospects after graduation

- Applicant’s academic performance to date

- (If applicable) Extra-curricular activities and/or other professional qualification

- (If applicable) Applicant’s work experience to date

- (If applicable) Applicant’s international experience and mobility

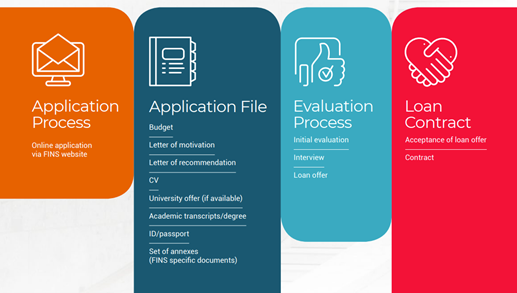

Application Process

After the interview, we aim to offer the student a customized financial offer, based on their needs, in 72h.

The loan offer will detail

- How much they can borrow

- Structure of the loan disbursements

- What’s the interest rate and APR

- Monthly repayments during usage period

- Monthly repayments during grace period

- Monthly repayments when they find a job